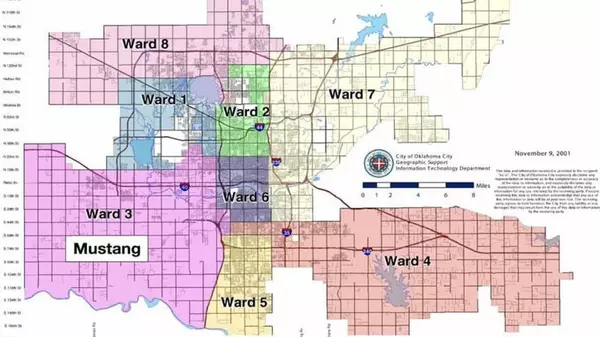

July in OKC: What Homebuyers Should Know Right Now

Hey Friends 👋 If you’ve been casually browsing homes or thinking about jumping into the market, here’s a quick July update on what’s going on around Oklahoma City. 🏡 More Homes, More Choices We’re seeing more homes pop up on the market than we did earlier this year—especially in that $250K–$400K r

Thinking of Selling Your OKC Home As-Is for Cash? Read This First.

If you're dealing with a home that needs repairs, inherited a property you’re not sure what to do with, or just want to move quickly — a cash, as-is sale might sound pretty appealing. And honestly? In the Oklahoma City market, it can absolutely make sense in the right situation. But before you sign

How to Spend a Day (or Less) in OKC

Got just a few hours or a full day to explore Oklahoma City? You’re in luck. Even a short stop in OKC can leave a big impression. This city is full of charm, culture, and unexpected fun—whether you're passing through, on a long layover, or just have a packed schedule. Here's how to make the most of

- 1

- 2

- 3

- 4

- 5

- ...

- 15

Categories

Recent Posts