Understanding Homestead Exemption and Additional Tax Programs in Oklahoma

Understanding Homestead Exemption and Additional Tax Programs in Oklahoma

If you’re a homeowner in Oklahoma, you may be eligible for various property tax programs, including the homestead exemption and other valuable benefits. These programs are designed to provide financial relief to homeowners under specific circumstances. Let’s break down the key details to ensure you don’t miss out.

Homestead Exemption

The homestead exemption reduces the taxable value of your primary residence by $1,000, which lowers your property tax bill. Here’s how it works:

- Ownership on January 1: You must own your home and live on the property as of January 1 of the tax year.

- Primary Residence: This must be your primary residence; exemptions cannot apply to second homes or investment properties.

- Automatic Renewal: Once approved, the exemption automatically continues each year unless you move to a new property.

Double Homestead Exemption

If you qualify for the homestead exemption and have an annual household income of $30,000 or less, you may also be eligible for the double homestead exemption.

- Proof of Income Required: Applicants must provide income verification and reapply annually.

- Permanent at Age 65: Once you turn 65, this exemption becomes permanent and does not require yearly reapplication.

Senior Valuation Limitation (Senior Freeze)

This program freezes the assessed value of your home, ensuring that your property’s value does not increase (unless the property is improved).

- Age Requirement: You must be 65 or older as of January 1 of the year you apply.

- Income Limit: Annual household income must be $86,000 or less. This limit may vary each year based on HUD guidelines.

- Important Note: This freeze applies to the property’s value, not the taxes themselves. Taxes may still fluctuate due to changes in budgets or bond issues.

100% Disabled Veterans Exemption

This exemption provides full tax relief for qualifying veterans or their surviving spouses.

- Eligibility: Veterans (or their spouses) must be 100% disabled with no future evaluations, as determined by the Veterans Administration.

- Documentation Required: A VA letter confirming the disability status and a valid photo ID must be submitted.

When to File

The filing period for these exemptions is from January 1 to March 15 each year. For most exemptions, you need to file only once unless specified otherwise (e.g., double homestead requires annual reapplication unless you’re over 65).

Where to Apply

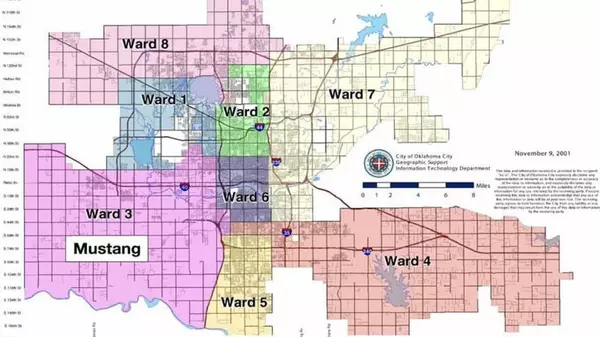

Visit your county assessor’s office to file for these exemptions. Here are links to some county-specific resources:

- Oklahoma County: Homestead Exemption Information

- Canadian County: Homestead Exemption Information

- Cleveland County: Homestead Exemption Information

- Logan County: Homestead Exemption Information

If your home is in a different county, reach out to me, and I’ll help you locate the correct office.

Final Thoughts

These property tax programs are designed to help Oklahoma homeowners save money and manage their taxes more effectively. Whether you qualify for the basic homestead exemption, a senior freeze, or veteran benefits, be sure to apply on time and provide the necessary documentation.

Have questions or need guidance? Let me know—I’m here to help you navigate the process!

Categories

Recent Posts