How to Buy a Home in Oklahoma - For First Time Home Buyers.

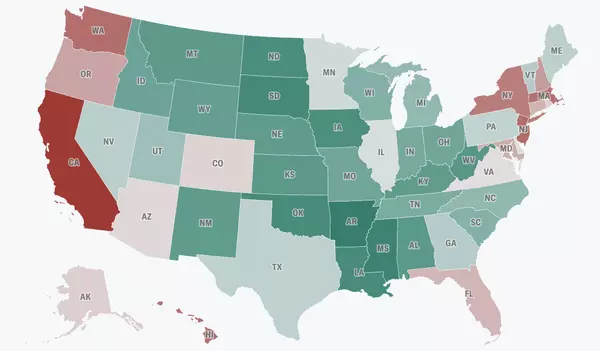

Are you thinking of buying a home but don't know where to start or how much it may actually cost. Here is the step by step process as well as how much it's actually going to cost you to buy a home. Here in the great HIGHLY AFFORDABLE State of Oklahoma!

Step 1: Hire an Agent.

-

- Let's be honest. Yes! you could buy a house without a Realtor. You could also cut your own hair, represent yourself in court and do your own taxes but should you... probabably not. In oklahoma it does not cost buyers to use a realtor BUT it could cost you a lot more not to. So please use a qualied professional to help you with the largest purchase you'll likely make in your life. You will thank me later.

Step 2: The Pre-Approval

-

- I highly recommend speaking to a lender BEFORE you start the home search. Ask your real estate agent for some recommendations!

- The lender will be able to guide you as to what type of loan is best for you, how much mortgage you can afford, what the actual costs of buying a home will be and where those funds can come from.

- Most lenders will have specific requirements such as a minimum credit score and a max debt-to-income ratio. As a general guideline assume a min 580 credit score and a DTI under 45%. But there are loan programs to help buyers who may not meet those requirements.

What Are The Actual Costs of Buying a Home?

-

- Down Payment: 0--20%

- if you are a first time home buyer you will likely qualify for an FHA loan which requires only 3.5% down

- VA requires 0% down

- Conventional - typically requires atleast 5% down but also has a 3% down for some first time home buyers

- USDA - some rural homes may qualify for 0% down

- Your lender may also offer down payment assistance.

- Closing Costs: 1-3% (avg $8k on a $300,000 home)

- These costs include items such as pre paid home owners insurance and taxes as well as lending fees.

- Depending on the current market you may be able to ask the seller of the home to pay these costs for you.

- Down Payment: 0--20%

There are also some upfront costs when purchasing a home.

- Earnest Money - 1% of purchase price

- This is applied to down payment / closing costs on closing day and is less money you need to bring.

- Appraisal - $600 average

- This is typically paid upfront by buyer.

- Home Inspection - $350-500

- this is optional but HIGHLY remommended.

- Additional Inspections - Vary

- you may be purchasing a property that has additional features such as a shop, pool or well that you may want to also have inspected.

- Termite Inspection - $125

- This is optional except for VA & FHA loans

Step 3: The Home Search

The fun part begins! Here are some tips to help make the best of your home search.

-

- Use search filters but don't go crazy.

You don’t want to restrict your search so tightly that you only have a handful of homes to view. Keeping your wants vs. needs list in mind, expand your geographic search, and add 25-50K to your max price since there is sometimes wiggle room with pricing and negotiations.

If you find something that catches your eye. Look them up on google street view. Pictures can be deceiving, so a virtual ‘walk down the street’ will give you a better sense of the house and surrounding area.

Jot down the MLS number and give it to your agent. They will gather pertinent info not available not available on Zillow.

- Use search filters but don't go crazy.

While at showings keep an eye out for:

- Your wants & needs

- Take pics & videos to jog your memory later

- Consider lot size & location (these can't be changed)

- Look for signs of structural integrity

- (water damage, cracks, sloping floors)

- Pay attention to noise levels

- Examine roof for leaks or other damage

- Consider layout & space

- Look past decor & staging

- Consider potential resale value

You've Found the One.... Now What?!

Step 4: Writing an Offer

-

- Lean on your trusted Realtor to help write a compelling offer.

- Include your Pre-Approval letter

- Put your best foot & price forward

- Limit inspections to health & safety. This will show the seller you're not going to be nit picky during inspections.

Step 5: You're Under Contract

-

- Provide earnest money. This is typically 1% of the sales price and due within 3 days of going under contract. This deposit shows your commitment to buying the property and is held in an escrow account until the closing and then is credited to your balance.

-

- Schedule Home Inspection – Inspections are optional but I highly recommend. Once the home inspection report comes In, there may be repairs that you’ll want to negotiate with the seller.

-

- Order Appraisal – Your lender will order the appraisal Ito ensure the property's value matches the sale price. If the appraisal comes in low, you may need to renegotiate with the seller or come up with additional funds.

-

- Title Search – A title company will conduct a title search to ensure there are no liens or legal issues with the property’s ownership.

-

- Final walk-through – Shortly before the closing date, you'll have the opportunity to do a final walk-through of the property to ensure it's in the agreed-upon condition.

-

- Closing Day – Sign all necessary documents, pay remaining closing costs and the down payment. The title is officially transferred to you, and keys are exchanged.

- Closing Day – Sign all necessary documents, pay remaining closing costs and the down payment. The title is officially transferred to you, and keys are exchanged.

Step 6: Closing Day

-

- Overall you can expect the home buying process to take 30 days

- On Closing day you'll show up to sign documents and bring your down payment & closing costs as previously discussed with your lender.

- You'll get the keys! (to a vacant house ready to become HOME)

I hope this guide helps answer some of your home buying questions.

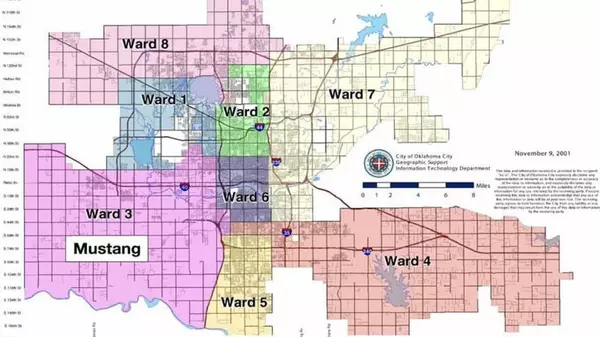

If you live or are relocating to the Oklahoma City Metro (Yukon, Mustang, Edmond, Gutherie, Moore, Norman & surronding areas) and still have questions or need assistance please feel free to contact me. No pressure and absolutely FREE. I am here to help you achieve home ownership!

-Sabrina Adams

Categories

Recent Posts